Experts Predict Home Values to Increase 1.5% to 3.6% in 2025.

Leading housing experts and economists offer insights into the projected trends for mortgage rates, home values, and the overall national real estate market in 2025.

Key Takeaways

Mortgages in Denver are projected to remain at elevated levels for an extended period; nevertheless, there are strategies you can implement to potentially reduce your interest rate.

Home values in Denver are anticipated to experience gradual growth on a national scale; and there are renovation projects you can undertake to enhance the value of your property.

The overall national real estate market is expected to lean towards favoring sellers during negotiations; however, it’s essential to remember that real estate trends are heavily influenced by local factors, meaning the market dynamics could lean towards either buyers or sellers based on the specific area.

Note: the real estate market is constantly evolving, and the projections mentioned in this content may evolve as the year progresses.

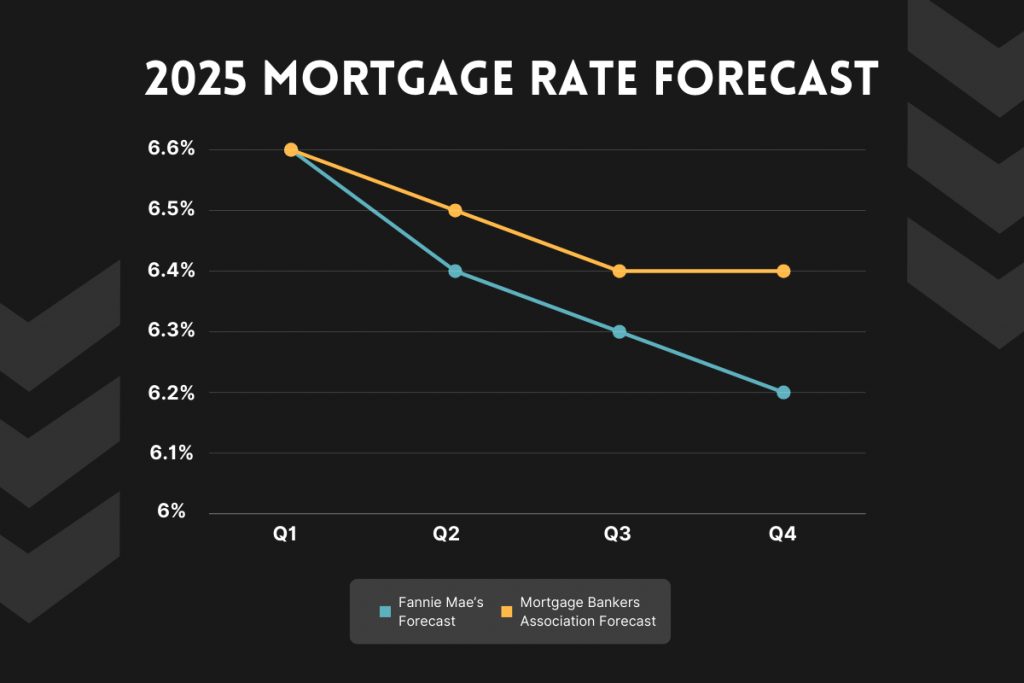

Mortgage Rates Will Average 6.4% in 2025

In 2023, the average 30-year mortgage peaked at 7.79% following the pandemic. Rates came down from that peak in 2024. Wondering what will happen to mortgage rates in the upcoming year?

The Federal Reserve is anticipated to decrease the federal funds rate 6 to 8 times in 2025; however, it’s important to note that mortgage rates are not directly influenced by the Federal Reserve and may not experience a significant drop (National Association of REALTORS®).

Fannie Mae projects mortgage rates to average 6.4% in 2025. Mortgage Bankers Association also anticipates mortgage rates to average 6.4%, albeit with slightly higher rates compared to Fannie’s estimate.

Sources: Fannie Mae Housing Forecast: November 2024 and

Mortgage Bankers Association Mortgage Finance Forecast: November 2024

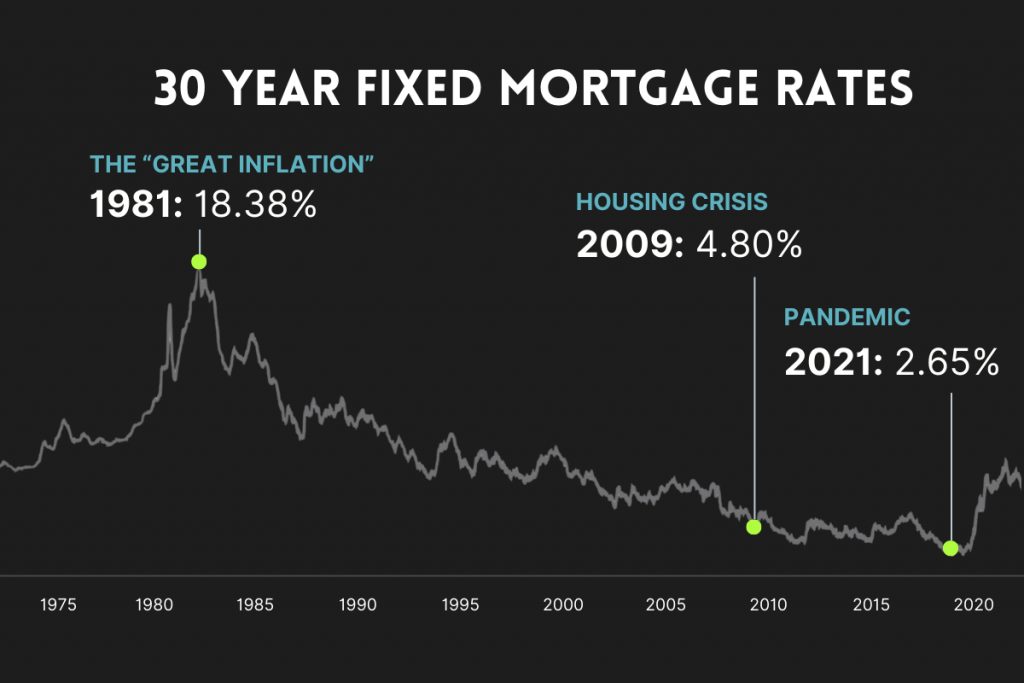

When Will Mortgage Rates Drop Back to 3%?

Unprecedentedly low, the interest rates during the pandemic era have set a record. The average 30-Year mortgage rates hovered between 4% and 6% in the aftermath of the housing crisis and Great Recession. Reverting to a 3% range is highly improbable.

Source: Federal Reserve of St. Louis

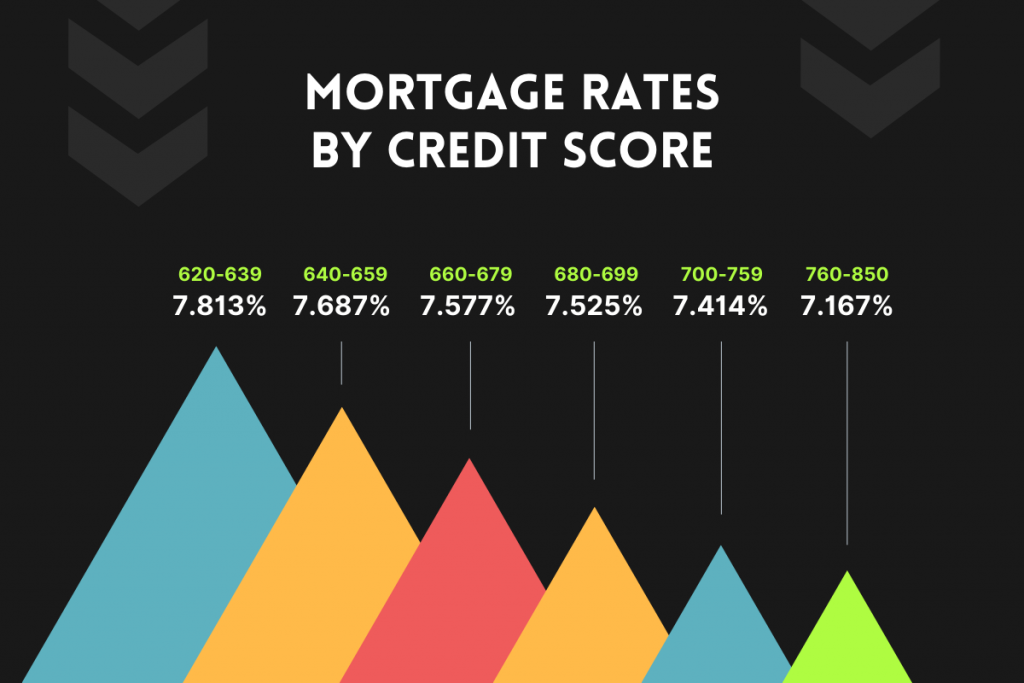

Tips to get a better mortgage rate…

While we can’t affect the average 30 year mortgage rate, you can improve your credit and get the best possible rate. Here’s an example of recent mortgage rates by credit score:

Source: myFICO.com

If you’re considering a relocation, it’s wise to connect with a mortgage finance expert sooner rather than later. This proactive approach allows ample time to enhance your credit score, increasing your chances of securing a favorable interest rate for your home purchase in Denver. Reach out to Just Livin' Realty Group at 720-799-2202 today to start this important conversation.

Need a recommendation to a trusted lender? Send me a message.

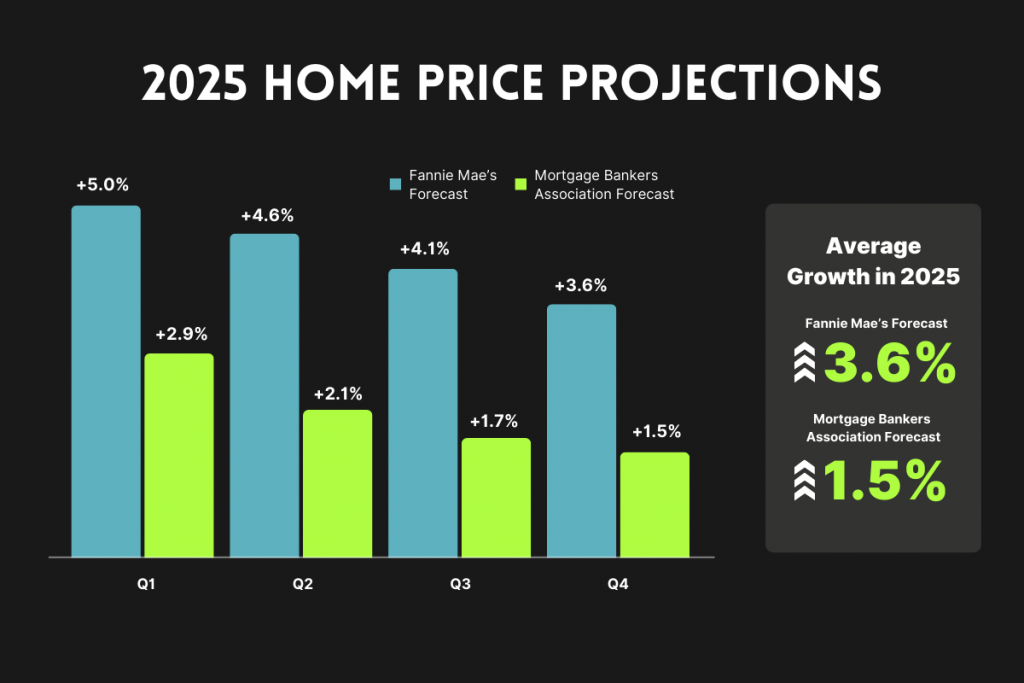

Home Values Will Increase by 1.5% to 3.6%

Since 2020, the average sales price of a home has risen by $97,000 or 29.7% (Federal Reserve of St. Louis), highlighting homeownership as a lucrative investment. Looking ahead, what can we expect for home values in the upcoming year?

Nationally, home price growth is forecasted to decelerate starting from 2024. Nevertheless, a surge in home prices is anticipated for 2025. Fannie Mae projects an average increase of 3.6%, while MBA foresees a moderate rise of 1.5% on average.

Sources: Fannie Mae Housing Forecast: November 2024 and Mortgage Bankers Association Mortgage Finance Forecast: November 2024

Home values are influenced by local market dynamics. If you want to understand what home values are forecasted to do locally, consider talking to a real estate professional.

Want to increase your home’s value? Consider these remodeling projects for the highest return on investment.

Will Home Values Crash in 2025?

Significant drops in home values require a substantial increase in homes for sale. According to Freddie Mac, the U.S. housing stock falls short by 3.7 million units to satisfy demand. Building up inventory to match demand is a gradual process. Therefore, a considerable decline in home values is improbable at this time.

Will 2025 Be a Home Buyers or Sellers Market?

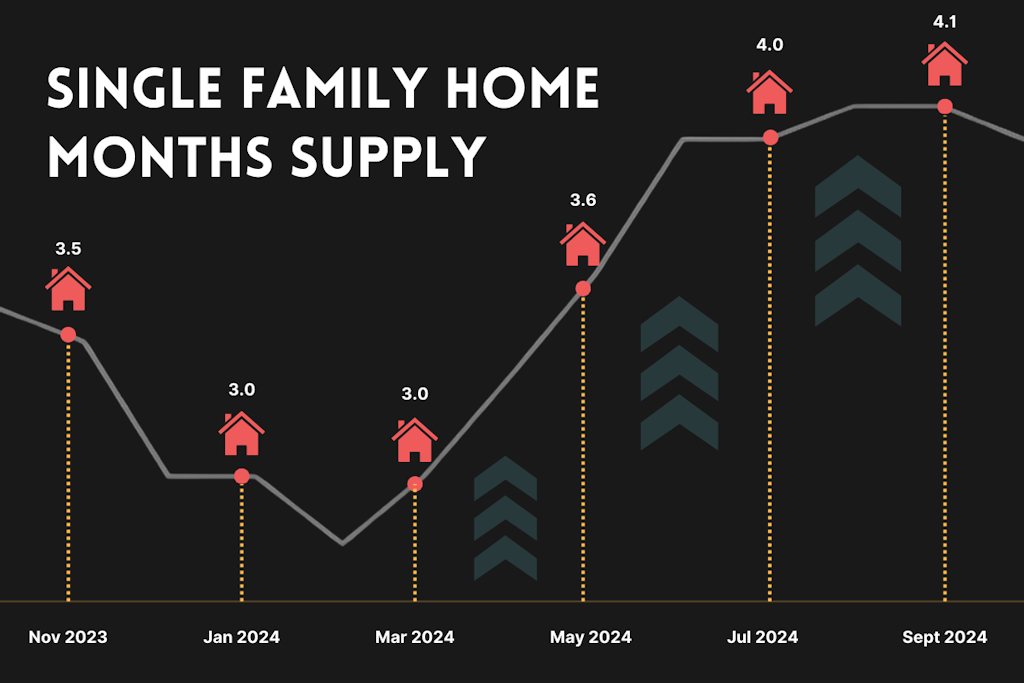

Who will have the advantage in the 2025 housing market, buyers or sellers? One measure of the market is Months Supply and it shows who has the advantage.

Months Supply is calculated by dividing the total number of homes for sale by the average number of homes sold each month. For example, if there are 500 homes for sale in a particular area and an average of 100 homes are selling each month, the Months Supply is 5 months.

Here’s a chart of month’s supply going back to November of 2023:

Source: Federal Reserve of St. Louis

6 Months Supply is considered a balanced market. Over 6 months supply is considered a buyers’ market. Below 6 months supply is a sellers’ market. At 4 months supply on a national level, the market slightly favors sellers.

Inventory is rising nationally, however, which could shift the market to favor buyers in the next year. With that said, all real estate is local and local markets will differ in favoring buyers versus sellers.

If you want to know if your area favors buyers or sellers, send me a message.

What This Means for Homeowners

If you are a homeowner in Denver, you may notice a modest uptick in your property’s value. To further enhance your home’s worth and elevate your living experience, contemplate investing in strategic home improvements. For tailored recommendations on the most impactful upgrades and projects to boost your home’s value, reach out to the experts at Just Livin' Realty Group in Denver, CO. Contact us at 720-799-2202 for personalized guidance.

Tips for Potential Home Buyers

If you’re considering buying a home in Denver, the time to start planning is now. Understanding your budget, improving your credit score, and saving for a downpayment are crucial steps to take at this stage. Whether you’re ready to make a purchase within the next 12 to 24 months or simply exploring your options, initiating a conversation with a real estate expert early on can significantly enhance your chances of a successful transaction.

Tips for Potential Home Sellers

Home sellers in Denver must prioritize their objectives when considering a sale. Is achieving top dollar the primary goal, or is it more important to sell quickly? Are there constraints, such as needing to sell before buying a new home? By clearly defining these objectives, a tailored plan and marketing strategy can be developed to meet your needs. When contemplating a move in Denver, consult with the experts at Just Livin' Realty Group by calling 720-799-2202!