What is the right time to start getting financially prepared to buy a home? Contrary to popular belief, you should get ready way before you actually start looking at listings and contacting real estate agents. It is because most homebuyers typically finance their purchase with a mortgage loan and to get one, there are several formalities to fulfill.

Once you prepare in advance, you can cross the hurdles and last-minute snags that might come up when applying for a mortgage. Further, for first-time home buyers, getting a mortgage loan might be challenging, what with several conditions to be met.

Even for homebuyers planning their second or third purchases, it is advisable to get ready for a mortgage loan well in time so that surprises do not pop up at any time. You can never say what you might encounter. Not only are mortgage eligibility norms continuously changing along with interest rates but the rules are becoming stricter by the day.

In this post, we will go into three simple steps that will take you seamlessly toward getting a mortgage loan without any hassles.

STEP 1: CHECK YOUR CREDIT SCORE

The first parameter that any lender will check when you apply for a mortgage loan is your credit score. Hence, before applying for a loan, review your credit score to check that it is correct. At times mistakes do creep into the report which might take months to rectify. Moreover, if you have a low score, you should have enough time on your hands to raise it before the report is scrutinized by the lenders.

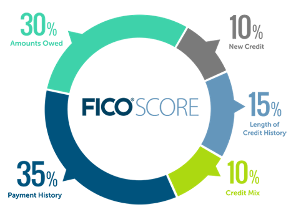

Most lenders use the FICO (Fair Isaac Corporation) score to evaluate your financial standing. It is a weighted score that considers five parameters – Payment history (35%), debts (30%), length of credit history (15%), new credit (10%), and credit mix (10%).

Source: myFico.com

Base FICO scores range from 300 to 850. A higher FICO score will help you qualify for a lower mortgage interest rate, which will save you money.2

By federal law, you are entitled to one free copy of your credit report every 12 months from each of the three major credit bureaus (Equifax, Experian and Transunion). Request your free credit report at https://www.annualcreditreport.com.

Minimum Credit Score Requirements

To qualify for the lowest interest rates available, you will usually need a FICO score of 760 or higher. Most lenders require a score of at least 620 to qualify for a conventional mortgage.3

If your FICO score is less than 620, you may be able to qualify for a non-conventional mortgage. However, you should expect to pay higher interest rates and fees. For example, you may be able to secure an FHA loan (one issued by a private lender but insured by the Federal Housing Administration) with a credit score as low as 580 if you can make a 3.5 percent down payment. And FHA loans are available to applicants with credit scores as low as 500 with a 10 percent down payment.4

Increase Your Credit Score

If you have a low credit score, it is not the end of the world as there are ways that you can increase it to the satisfaction of the lenders. Even though there is no quick fix, follow the steps given below to see an improvement in the score.

1. Make Payments on Time

The biggest chunk of importance in a credit score is given to payment history at 35%. Hence, focus on this area and do not get into any late payments. Ensure that all your future payments are made on time. Use apps and online banking platforms to set payment reminders and automatically debit monthly dues on due dates.

2. Avoid Applying for New Credit You Don’t Need

When you are sure that you will be applying for a mortgage loan in the foreseeable future, do not take any new loans. They lower the average age of the account and adversely affect the length of your credit history. Additionally, there might be a small decrease in the credit score when you apply for fresh credit.

Here is an example to illustrate this point better. You can apply for a new loan account, say a car loan but do not linger over it, complete your loan application quickly. It is because FICO attempts to distinguish between a search for a single loan and applications to open several new lines of credit by the window of time during which inquiries occur.

On the other hand, if you do not have any credit accounts at all including credit cards, you should open a new account to establish a credit history. Make sure that the account is responsibly operated and that all dues are cleared promptly every month.

3. Pay Down Credit Cards

Suppose you have multiple credit cards or other revolving credit; you must lower your amounts owed before applying for a mortgage loan. This is also known as credit utilization ratio which is the ratio of account balances to credit limits.

There are two ways that you can do it. The first is paying off the highest-interest debt first so that the burden of interest on the outstanding balance is lowered. The second is paying off the account with the lowest balance first. The monthly payment on this loan can be used to close the next-lower balance, thereby creating momentum to lower your debt.

Whichever method you choose, the first step is to make a list of all of your credit card balances and then start tackling them one by one. Make the minimum payments on all of your cards except one. Pay as much as possible on that card until it’s paid in full, then cross it off your list and move on to the next card.

| Debt | Interest Rate | Total Payoff | Minimum Payment |

| Credit Card 3 | 3.11% | $6,300 | $252 |

4. Avoid Closing Old Accounts

Closing an old account will not remove it from your credit report. In fact, it can hurt your score, as it can raise your credit utilization ratio—since you’ll have less available credit—and decrease your average length of credit history.

Similarly, paying off a collection account will not remove it from your report. It remains on your credit report for seven years, however, the negative impact on your score will decrease over time.

5. Correct Errors on Your Report

Mistakes or fraudulent activity can negatively impact your credit score. That’s why it’s a good idea to check your credit report at least once per year. The Federal Trade Commission has instructions on their website for disputing errors on your report.

While it may seem like a lot of effort to raise your credit score, your hard work will pay off in the long run. Not only will it help you qualify for a mortgage, a high credit score can help you secure a lower interest rate on car loans and credit cards, as well. You may even qualify for lower rates on insurance premiums.6

STEP 2: SAVE UP FOR A DOWN PAYMENT AND CLOSING COSTS

After you work on your credit score, the focus should shift to saving up enough for a down payment and closing costs toward your mortgage loan.

Down Payment

When you take a mortgage loan to purchase a home a portion of it has to be paid in cash which is the down payment. The remaining balance of the mortgage loan is the part of the loan to buy your house.

The main point here is how much you have to save toward a down payment. The answer is that there is no benchmark in this case and the higher you pay as a down payment, the lower will be your expenses on interest and fees. If you pay 20% of the purchase price of a property as a down payment, not only will the interest rate be lower but also you do not have to pay mortgage insurance.

However, what happens if you have not saved enough for a 20% down payment? For a conventional loan in that case, you have to get private mortgage insurance (PMI). It is a buffer for lenders and covers the risk of the loan if you default on the mortgage payments.

PMI will cost you between 0.3 to 1.5 percent of the overall mortgage amount each year.8 So, on a $100,000 loan, you can expect to pay between $300 and $1500 per year for PMI until your mortgage balance falls below 80 percent of the appraised value.9 For a conventional mortgage with PMI, most lenders will accept a minimum down payment of five percent of the purchase price.7

If a five-percent down payment is still too high, an FHA-insured loan may be an option for you. Because they are guaranteed by the Federal Housing Administration, FHA loans only require a 3.5 percent down payment if your credit score is 580 or higher.7

The downside of getting an FHA loan? You’ll be required to pay an upfront mortgage insurance premium (MIP) of 1.75 percent of the total loan amount, as well as an annual MIP of between 0.80 and 1.05 percent of your loan balance on a 30-year note. There are also certain limitations on the types of loans and properties that qualify.10

There are a variety of other government-sponsored programs created to assist home buyers, as well. For example, veterans and current members of the Armed Forces may qualify for a VA-backed loan requiring a $0 down payment.7 Consult a mortgage lender about what options are available to you.

| TYPE | MINIMUM DOWN | ADDITIONAL FEES |

| Conventional Loan | 20% | Qualify for the best rates and no mortgage insurance required |

| Conventional Loan | 5% | Must purchase private mortgage insurance costing 0.3 – 1.5% of mortgage annually |

| FHA Loan | 3.5% | Upfront mortgage insurance premium of 1.75% of loan amount and annual fee of 0.8 – 1.05% |

Current Homeowners

If you’re a current homeowner, you may have equity in your home that you can use toward your down payment on a new home. We can help you estimate your expected return after you sell your current home and pay back your existing mortgage. Contact us for a free evaluation!

Closing Costs When Buying a Home

Closing costs should also be factored into your savings plan. These may include loan origination fees, discount points, appraisal fees, title searches, title insurance, surveys and other fees associated with the purchase of your home. Closing costs vary but typically range between two to five percent of the purchase price.11

If you don’t have the funds to pay these outright at closing, you can often add them to your mortgage balance and pay them over time. However, this means you’ll have a higher monthly payment and pay more over the long term because you’ll pay interest on the fees.

STEP 3: HOW MUCH HOUSE CAN YOU AFFORD? YOUR HOME PURCHASING POWER

Now that you have set the required credit score, arranged for your down payment, and listed out all your debts from your credit report, you can easily gauge whether you are ready to purchase your dream home. You will also know what type of house you can afford and the amount that you can borrow as a mortgage loan.

The key metric for knowing how much you can borrow is the debt-to-income ratio. Based on this ratio, lenders will decide the quantum of the loan that will be sanctioned to you. Calculating the DTI will also help you assess whether you have set realistic home purchasing goals given your present financial strength.

The DTI compares all your debts and monthly expenses against your total income. Lenders consider two types of DTI.

Front-End Ratio

To calculate this ratio, lenders add up all the expenses connected to your house and divide it by the total monthly income before taxes. Housing expenses for this ratio include mortgage payments, property taxes, homeowners’ insurance, private mortgage insurance, and association dues.

To get a mortgage loan, this front-end DTI ratio should be 28%. It is pushed to 31% for FHA-backed loans.

Back-End Ratio

The back-end ratio takes into account all of your monthly debt obligations: your expected housing expenses PLUS credit card bills, car payments, child support or alimony, student loans and any other debt that shows up on your credit report.12

To calculate your back-end ratio, a lender will tabulate your expected housing expenses and other monthly debt payments and divide it by your gross monthly income (income before taxes). The maximum back-end DTI ratio for most mortgages is 36 percent. For an FHA-backed loan, this ratio must not exceed 41 percent.13

Home Affordability Calculator

To get a sense of how much home you can afford, we have developed the ULTIMATE Home Owner Experience. For affordability calculators, mortgage payment calculators, e-books, guides, market updates, and more. Visit the download page free Home Affordability Calculator at https://bobfriel.cardtapp.com.

This handy tool will help you determine your home purchasing power depending on your location, annual income, monthly debt and down payment. It also offers a monthly mortgage breakdown that projects what you would pay each month in principal and interest, property taxes, and home insurance.

The Home Affordability Calculator defaults to a back-end DTI ratio of 36 percent. If the monthly cost estimate at that ratio is significantly higher than what you’re currently paying for housing, you need to consider whether or not you can make up the difference each month in your budget.

If not, you may want to lower your target purchase price to a more conservative DTI ratio. The tool enables you to scroll through higher and lower price points to see the impact on your monthly payments so you can identify your ideal price point.

(Note: This tool only provides an estimate of your purchasing power. You will need to secure pre-approval from a mortgage lender to know your true mortgage approval amount and monthly payment projections.)

Can I Afford to Buy My Dream Home?

Once you have a sense of your purchasing power, it’s time to find out which neighborhoods and types of homes you can afford. The best way to determine this is to contact a licensed real estate agent. We help homeowners like you every day and can send you a comprehensive list of homes within your budget that meet your specific needs.

If there are homes within your price range and target neighborhoods that meet your criteria—congratulations! It’s time to begin your home search.

If not, you may need to continue saving up for a larger down payment … or adjust your search parameters to find homes that do fit within your budget. We can help you determine the right course for you.

START LAYING YOUR FOUNDATION TODAY

It’s never too early to start preparing financially for a home purchase. These three steps will set you on the path toward homeownership … and a secure financial future!

And if you are ready to buy now but don’t have a perfect credit score or a big down payment, don’t get discouraged. There are resources and options available that might make it possible for you to buy a home sooner than you think. We can help.

Want to find out if you’re ready to buy a house? Give us a call!

We’ll help you review your options, and connect you with Bobby Friel, who owns Friel-Good Mortgage, Inc. & Just Livin’ Realty Group. The ULTIMATE Homeowner Experience will save you time, energy, and money in the process.

The above references an opinion and is for informational purposes only. It is not intended to be financial advice. Consult a financial professional for advice regarding your individual needs.

Sources:

- Quicken Loans Blog –

https://www.quickenloans.com/blog/how-does-your-credit-score-affect-your-mortgage-eligibility - myFICO –

https://www.myfico.com/credit-education/credit-report-credit-score-articles/ - Bankrate –

https://www.bankrate.com/mortgages/what-is-a-good-credit-score-to-buy-a-house/ - Bankrate –

https://www.bankrate.com/finance/mortgages/7-crucial-facts-about-fha-loans-1.aspx - myFICO –

https://www.myfico.com/credit-education/improve-your-credit-score/ - The Balance –

https://www.thebalance.com/having-good-credit-score-960528 - Bankrate –

https://www.bankrate.com/mortgages/how-much-is-a-down-payment-on-a-house/ - Bankrate –

https://www.bankrate.com/finance/mortgages/the-basics-of-private-mortgage-insurance-pmi.aspx - Bankrate –

https://www.bankrate.com/finance/mortgages/removing-private-mortgage-insurance.aspx - The Balance –

https://www.thebalance.com/fha-home-loan-pitfalls-315673 - Investopedia –

https://www.investopedia.com/terms/c/closingcosts.asp - Bankrate –

https://www.bankrate.com/finance/mortgages/why-debt-to-income-matters-in-mortgages-1.aspx - The Lenders Network –

https://thelendersnetwork.com/fha-debt-to-income-ratio/